March is Fraud Prevention Month, a time to remind ourselves of the sneaky tactics scammers use to trick people out of their money, personal information, or both. With scams becoming more and more sophisticated (think phishing emails, and more often text messages that look legit, or phone calls from “your bank” that sound convincing), it’s important to stay sharp.

Here are five practical tips to help you avoid falling for some common scams this month (and beyond!):

1. Trust Your Gut – If It Feels Off, It Probably Is

Scammers are masters at creating urgency or emotional hooks to throw you off balance. Ever get a call or message saying your account’s been hacked and you need to “act now” to save it? Or an email claiming you’ve won a prize draw you don’t remember entering? Your instincts are your first line of defence.

If something feels suspicious, too good to be true, overly pushy, or just plain weird, pause and verify before acting. A quick search online or a call to the official source (using a number you look up, not one they provide) can save you a lot of trouble.

2. Guard Your Personal Info Like It’s Gold

Your Social Insurance Number (SIN), bank details, or even your email password are prime targets for scammers. One common trick is phishing – fake emails, texts, or websites designed to look real, asking you to “log in” or “update your info.” Before you share anything, double-check the sender’s email address and the website address. Hover over links (don’t click!) to see where they really lead.

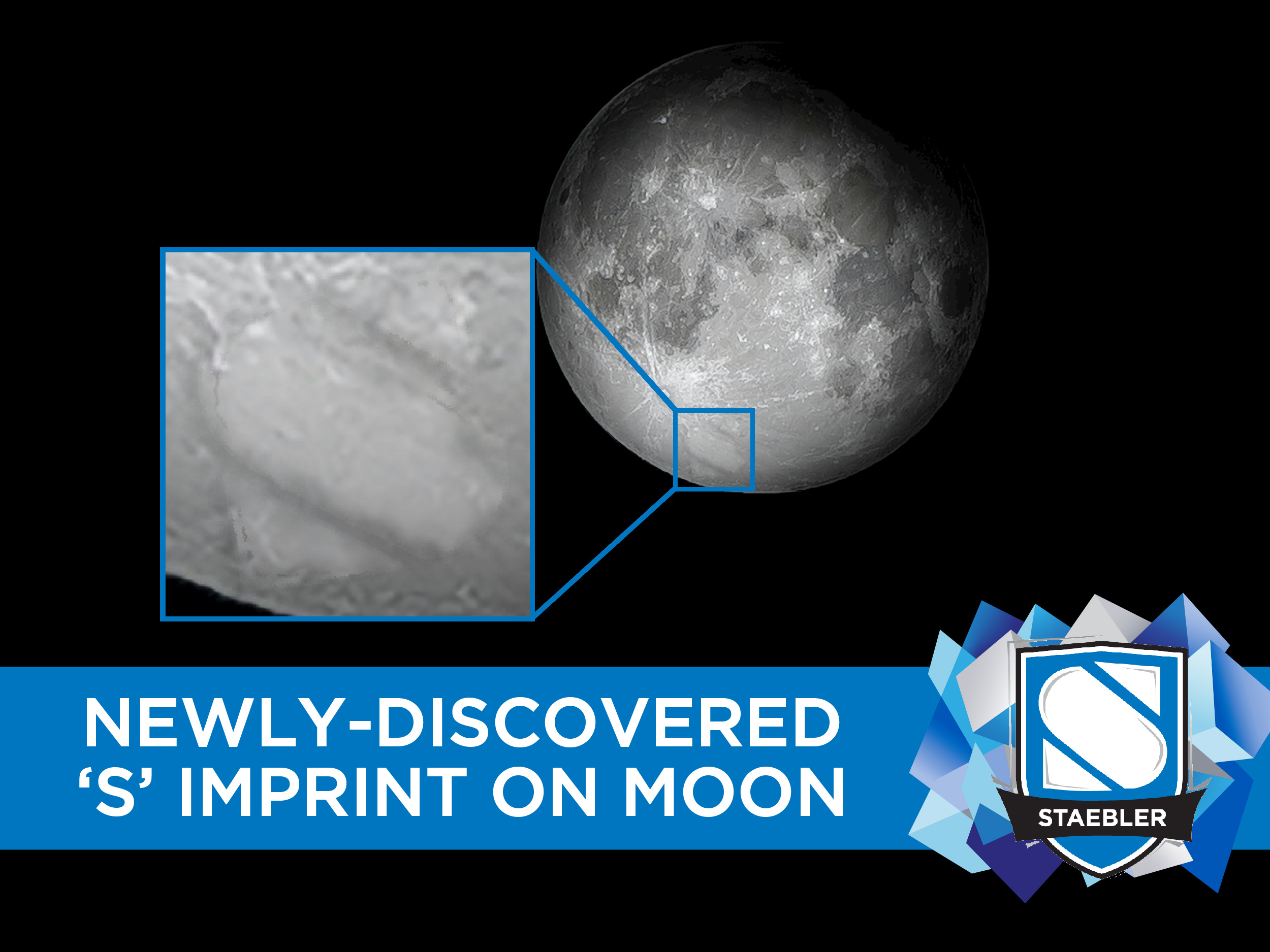

Be on the lookout for typos or slight changes in an otherwise legitimate link. For example, a scammer might change a single character to look legitimate and get past a casual glance (like changing “Staebler.com” to “5taebler.com” by replacing the “S” with a five).

Pro Tip: legitimate companies rarely ask you to verify sensitive info out of the blue. When in doubt, contact them directly through their official website or customer service line.

3. Hang Up on Unsolicited Calls

That “bank representative” or “tech support” calling you out of nowhere? Chances are, they’re not who they say they are. A popular scam involves fraudsters pretending to be from a trusted organization, claiming there’s an issue with your account that needs immediate attention. They might even have some of your info already (possibly because of other data breaches) to sound convincing. Don’t fall for it. Hang up and call the organization back using a verified number from their official website. If it’s real, they’ll confirm it—and if it’s not, you’ve just dodged a bullet.

4. Don’t Click Links or Reply (Unless You’re 100% Sure)

Text messages saying “Your package is delayed, click here to reschedule” or emails with attachments are some of scammers’ favourites. These links can lead to malware that steals your data or fake sites that takes your login info.

Before clicking anywhere, ask yourself: Am I expecting this message? Do I recognize the sender? If not, delete it. If you’re expecting a delivery, go straight to the company’s website to check the shipping status.

5. Educate Yourself on the Latest Scams

Scammers evolve faster than fashion trends, so staying informed is key. For Fraud Prevention Month, take time to browse resources like the Canadian Anti-Fraud Centre or locally the Waterloo Region Police Service – Fraud and Identity Theft. You can also search scam alerts on social media with hashtags such as #FraudAlerts or #FraudPrevention

Recently, romance scams, cryptocurrency cons, and impersonation schemes are hot. Knowing what’s out there (like fake “investment opportunities” promising huge returns) helps you spot the red flags before you’re in too deep.

Stay Skeptical, Stay Safe

Fraud Prevention Month is a reminder that scammers don’t take a break – but neither should your skepticism! By slowing down, verifying sources, and keeping your info secure, you can outsmart even the slickest con artists.

Share these tips with friends and family – because the more we share and talk about scams, the harder it gets for fraudsters to win.

. . .

Staebler Insurance is a general insurance broker specializing in car insurance, home insurance, small business insurance, and commercial insurance. Staebler Insurance Brokers proudly serve Kitchener, Waterloo, Cambridge, Guelph, Stratford, Listowel, Fergus, Elora, Wellington County, Perth County, Waterloo Region, the Greater Toronto Area, Golden Horseshoe, Niagara Region, and all over beautiful Ontario, Canada. Get a Quote to get started today.

0 Comments