Your Business Insurance

Fiction

“I don’t have enough risk in my business”

“I’m not big enough to need it”

“I‘m sufficiently covered by my personal insurance”

Facts

Business is risky.

You have more on the line than you might think.

Don’t risk your livelihood by not having the coverage you need.

You don’t need to be a millionaire to be sued like one.

Protect the income you and your employees rely on.

Your personal insurance is not enough! It does not cover your business.

Essential Business Insurance

PROPERTY

This covers your physical property including your buildings, your equipment, your materials or stock, tools, office furniture and more.

Not insuring to the full value can cost you! If you don’t have the right amount of insurance, your claim payment will be reduced. And remember, there is a difference between market value and rebuild/replacement cost.

BUSINESS INTERRUPTION

Could you go without income for weeks after a claim? This coverage can replace the income on which your family and your employees‘ families rely. Learn more about Business Interruption Insurance.

CRIME

35% of private companies in Canada experience a loss due to workplace crime. This covers those types of losses.

AUTO

If you rely on vehicles, getting back on the road means getting back to business!

GENERAL LIABILITY

Your personal liability is not enough! This covers your legal bills and settlements made against you and your business.

important extras for Business Insurance

EQUIPMENT BREAKDOWN

Keep your production line running! This covers sudden and accidental breakdown of electrical, mechanical and pressure equipment.

ENVIRONMENTAL IMPAIRMENT (POLLUTION LIABILITY)

Dirty deeds aren’t dirt cheap! This covers environmental remediation and clean-up expenses. Your General Liability alone won’t cover this.

ERRORS & OMISSIONS (PROFESSIONAL LIABILITY)

General Liability is not always enough! This provides coverage for your errors in your professional service and advice, resulting in financial loss for your customer.

CYBER (PRIVACY LIABILITY)

Access Denied! Your business is responsible for any private information you keep on file. You’ll need this coverage. Learn more about Cyber Insurance and Requirements.

DIRECTORS & OFFICERS (MANAGEMENT LIABILITY)

Your personal liability is not enough! This covers your legal bills and settlements made against you and your business.

Bonding (Surety)

CONTRACT BONDING

More and more, contractors are being required to provide bonding when bidding on or completing projects.

MISCELLANEOUS BONDING:

Lots of other businesses require bonding such as:

• Court Bonds

• Customs & Excise Bonds

• Licence & Permit Bonds

• Lost Document Bonds

Additional Perks for Our Clients

Insurance Premium Financing

We offer premium financing for commercial clients.

Please visit Commercial Premium Financing to learn more

Prestige Insurance Program

A dedicated and experienced Prestige Broker for your personal insurance. Receive superior service to handle your unique or complex personal insurance needs.

Learn more: Prestige Insurance Program

Group Rate Insurance

Group Rate Insurance provides discounts to help your employees save money on their car and home insurance, and it’s free to you!

Get started at Group Insurance Plan

Trucking Insurance Specialists

Staebler Insurance has robust experience in the trucking industry. Their transportation expertise and relationships with insurance companies help provide the best coverages at a sustainable price.

Please visit Staebler Knows Trucking Insurance to learn more

Related Blog Posts

What your Business needs to know about Compiled Financial Information

Important Changes Coming for Financial Statements For the first time in more than 30 years, the Chartered Professional Accountants of Canada (CPA) have updated its accounting standards for financial statements. The new rules help define what an accountant needs to...

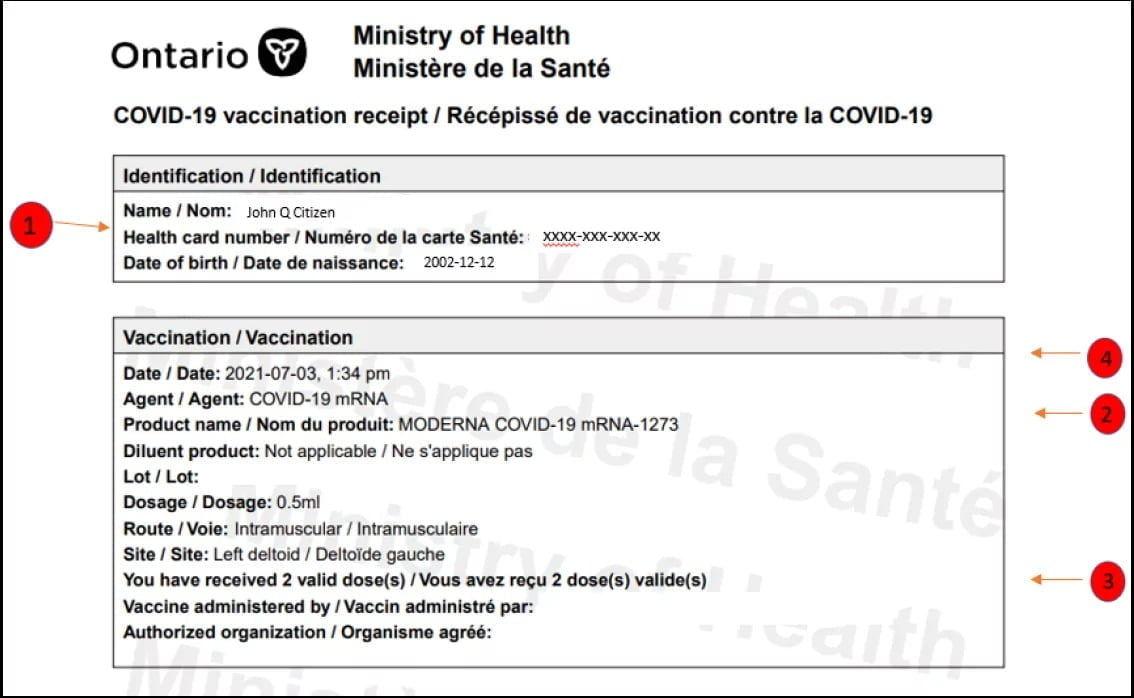

What Businesses Need to Know about Ontario’s Vaccination Certificates

Beginning Wednesday, September 22, 2021, the Province of Ontario is requiring proof of vaccination from patrons to enter select businesses. Ontario is joining other provinces with a vaccine certificate program that will eventually become a QR code (see update below)....

Why your Business needs Cyber Insurance in 2021

It’s becoming more frequent that we read a media report of a large, well-known organization that’s been the target of a cyber breach. Often sensitive data and client information is compromised and held for ransom by digital attackers. While the public usually only...

Ontario Insurers Alert Cargo Theft as a Big Threat

One of the biggest hits to a trucking firm’s insurance policy can be the theft of cargo and Ontario insurance companies are sounding the alarms to bring attention to this particular threat. Across the province, the transportation and logistics industry continues to...

Industry Recommendations to Help Insurance and Trucking Industries

The Insurance Brokers Association of Ontario (IBAO) and the Insurance Bureau of Canada (IBC) have partnered together to address insurance availability issues within the commercial trucking industry. For years, truck drivers with limited years’ experience, and their...

Good News for Property Owners and Snow Removal Operation Insurance Providers

Insurers, snow removal contractors, and commercial property owners in Ontario received some good news from the provincial government this month, ahead of the heavy snow fall season. A section of Bill 118, called the "Occupiers’ Liability Act”, will now limit claimants...

Why You Need Business Interruption Insurance

Insurance is bought to ensure if the unexpected happens, there’s a solution to make things better. Imagine an accidental garage fire: All of your possessions are lost, but insurance is there to get your items back and repair the damage. Now consider owning a business,...

Reopening Your Business in the Covid-19 Pandemic Environment

Tips to keep your workplace safe during COVID-19 The most important thing to remember is the health and safety of everyone - and that begins with employees. As always, under the Occupational Health & Safety Act (OHSA) business owners and operators are required to...

Covid-19: Changes to tell your Broker

With pandemic restrictions related to COVID-19 continuing to ease across Ontario and much of the province in Phase Two of the re-opening plan, there are important considerations to be aware of that may affect your insurance. More businesses have restarted operations,...